Contents

In this article, you will learn: how to bet with the ‘Kelly Criterion’ system, if you can profit from it, and how value betting relates to it. We will also use the ‘Kelly Criterion’ formula to make our own calculations, and search for reviews on the system on forums.

The Rules of the Strategy

The ‘Kelly Criterion’ strategy is deeply related to value betting. It allows you to determine the amount (percentage of the bank) you should value bet to maximize your profit based on all the risks and the probability theory.

When calculating the amount with ‘Kelly Criterion’, you should understand the tendencies in a particular sport and the percentage probability of a bet to win.

‘Kelly Criterion’ — Calculations, Formula

The formula used in ‘Kelly Criterion’ is the following:

( (Bookmaker Odds * The Predicted Outcome – 1) / (Bookmaker Odds – 1) ) * IDC * 100 = Bet Amount (in %)

- Bookmaker Odds— the odds for a particular event offered by the bookmaker.

- Predicted Outcome— your individual prediction of the probability of a bet to win. The figure varies between 0 and 1.

- IDC — the abbreviation stands for ‘increase/decrease coefficient’. This parameter ranges between 0 and 1 and is determined by each player individually. If your IDC is close to zero, the risks are minimal, but you can’t count on big winnings either. The closer the value is to 1, the more you can win, but you also run the risk of losing the entire bankroll. Once you determined the coefficient, you are supposed to stick to it for a long time — it is not recommended to change it.

Most players who use Kelly’s strategy opt for an IDC ranging between 0.2 and 0.4.

- Bet amount (%)— the percentage of the bank you need to bet.

The Strategy in Action. A Practical Example

Let’s illustrate the ‘Kelly Criterion’ strategy in action.

- First, we need to determine the bank size. Suppose, it’s 500 dollars.

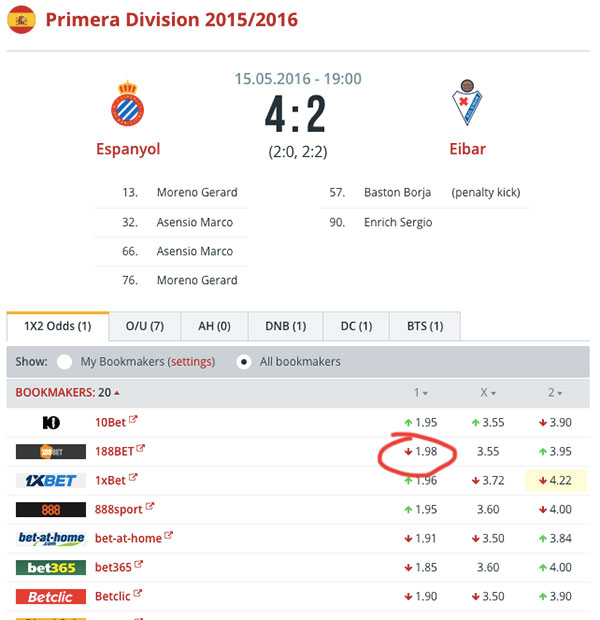

- Then we must choose the event. Let it be Espanyol – Eibar, the win of Espanyol

And so, the final, 38th round of the Spanish Primera. Espanyol has a home-field advantage. We consider the odds of 1.98 to be overvalued (how to find overvalued odds in practice).

- Bankroll — 500 dollars

- IDC — 0.25 (see how to choose the value above)

- Event: Espanyol – Eibar, the win of Espanyol

- Bookmaker odds — 1.98 (which equals around 51%)

- Predicted outcome — 60% or 0.6

Now let’s use the formula to calculate the amount of our bet:

Bet Amount (%) = ((1.98*0.60 – 1) / (1.98-1)) * 0.25 *100 = 4.79%

So, the amount of the bet should make 4.79% of our bankroll, which translates into 23 dollars and 95 cents.

As you can see from the example, our bet won, which increased our bankroll to 523 dollars and 47 cents. This is the number we will use when calculating our next bet.

A ‘Kelly Criterion’ Calculator

To simplify your calculations, you can use this online ‘Kelly Criterion’ calculator app.

Players’ Reviews

Reviews on ‘Kelly Criterion’ are quite negative which is easy to understand, as, to really earn with the strategy, you should not only go through a lot of statistics, have good knowledge of some sport, but also possess great intuition. Which is not something everyone has.

Edward Thorp About Kelly’s Strategy

Edward Thorp gave a great description of ‘Kelly Criterion’ in his book where he offered quite a number of tips and formulas that can help bettors increase their winnings when betting on sports pools. Besides, Thorn covered many other issues he had dealt with in his thirty years of betting.