Contents

Miller’s system, its essence, why few bettors can successfully use it in practice — all these issues will be covered in the article below.

J.R. Miller is a famous professional player who is known not only as a bettor but also as the author of the following books:

- How Professional Gamblers Beat the Pro Football Pointspread;

- Professional Gambler.

For many bettors, these works have become go-to books.

Miller’s strategy in sports betting has various names including ‘Miller’s Financial Management’ and ‘Miller’s Money Management’.

The Basics of Miller’s Strategy

The system is based on flat betting. Miller offers very strict conditions that must be scrupulously fulfilled:

- The odds must be higher than 1.9 which means that the betting events must have two equally probable outcomes. Simple calculations show that, in this case, the win rate must be over 50% because of the margin (what is margin and why you need to take it in to account).

100/1.9 = 52.63%. In other words, 53 out of 100 bets must win. - The bet amount must make 1% of the bankroll. Miller considers a 2-percent bet risky and a 3-percent bet — most likely leading to bankruptcy.

- The bet amount stays the same until the bankroll has increased by 25% compared to the initial amount. After that, a new bet amount is calculated. The percentage remains the same.

Miller is credited for determining the parameter on reaching which the bet amount is recalculated and the player goes to the next level of the game — either an upper or a lower one. So, depending on the changes in the bankroll (the win rate of the game), the bet amount is either increased or decreased.

One important factor that determines success of a bettor is the amount of bookmaker’s margin. It tells on the odds for equally probable events while the odds tell on the win rate (breakeven point). For example, for odds 1.9, the win rate will be 52.63% (see above how we got this number).

An Example of a Profitable Game Using Flat-Based Miller Strategy

Your bankroll is 10,000 dollars. The fixed bet amount in 1%. During a month, you make 50 100-dollar bets with the odds 1.9. 27 or 54% out of your bets win. The result is not bad, as the breakeven point (win rate) is 100/1.9=52.63%

Your profit is:

27*100*1.9 – 50*100=130 dollars.

So, the primary condition for a successful game is the dominating win rate.

Miller’s Strategy in Sports

Let’s see what football, basketball, or tennis events can be used in Miller’s system.

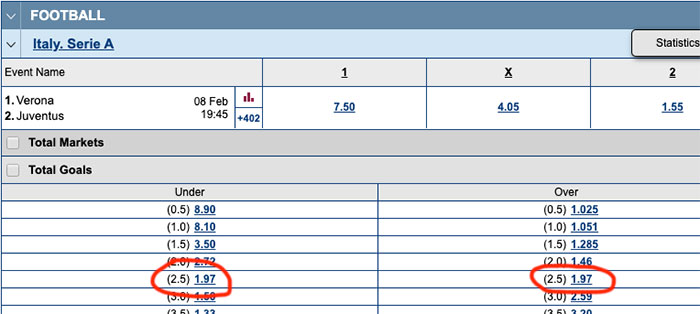

Football

Italy Serie A. Verona — Juventus

Total Under (2.5) — 1.97 | Total Over (2.5) — 1.97

For these odds, the win rate must be: 100/1.97 = 50.76%. Which means that, on average, you must correctly predict about 51 events out of 100.

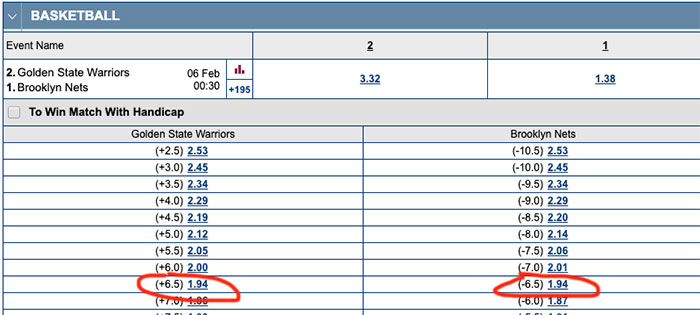

Basketball

NBA. Golden State Warriors— Brooklyn Nets

Handicap2(-6.5) – 1.94 | Handicap1(+6.5) – 1.94

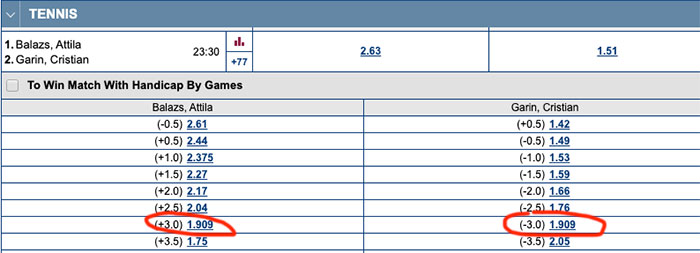

Tennis

ATP World Tour 250. Balazs, Attila — Garlin, Cristian

Handicap1 (-3.0) – 1.909 | Handicap2 (+3.0) – 1.909

Conclusions

According to reviews on the strategy, many bettors recognize its obvious merits. Still, few find it possible to follow the strict rules.

Miller himself was very disapproving of gamblers who play just for the trill of it, hoping to ‘hit the jackpot’. His principles of financial bankroll management allow for making profit in the long run, provided you follow all the rules and the win rate is 53% (or a different one, depending on the odds).

A curious fact: It is hard to believe but, in real life, the win rate for professional bettors usually varies between 53 and 58%. 60% is considered to be a very good result.

But the question is, will you be able to correctly predict 53 events out of 100?